Money Laundering Explained – Criminal activities generate huge illegitimate cash that needs to be converted into plausible income for lawful access without raising doubts or retaliation to the financial authorities. With relevant examples of money laundering techniques, the blog sheds light on what are the 3 stages of money laundering exploited by criminals in the present age to convert their dirty money into white and to be legally accepted.

Contents:

- What is Money Laundering

- What are the 3 Stages of Money Laundering

- Placement

- Layering

- Integration

- Examples of Money Laundering

- IDMERIT AML Solutions for Businesses

What is Money Laundering

Money laundering is a complex method of converting a large amount of illegally gained profit into lawfully acceptable form. The term ‘money laundering’ is derived from the idea of cleaning, i.e., laundering ‘dirty money’ into white money, for its integration into the financial system.

Money Laundering is considered a serious punishable offense involving all sorts of people, from corporate to street offenders. The proceeds of crime sources include felonious activities like narcotics trafficking, bribery, corruption, terrorist financing, human trafficking, etc.

What are the 3 Stages of Money Laundering

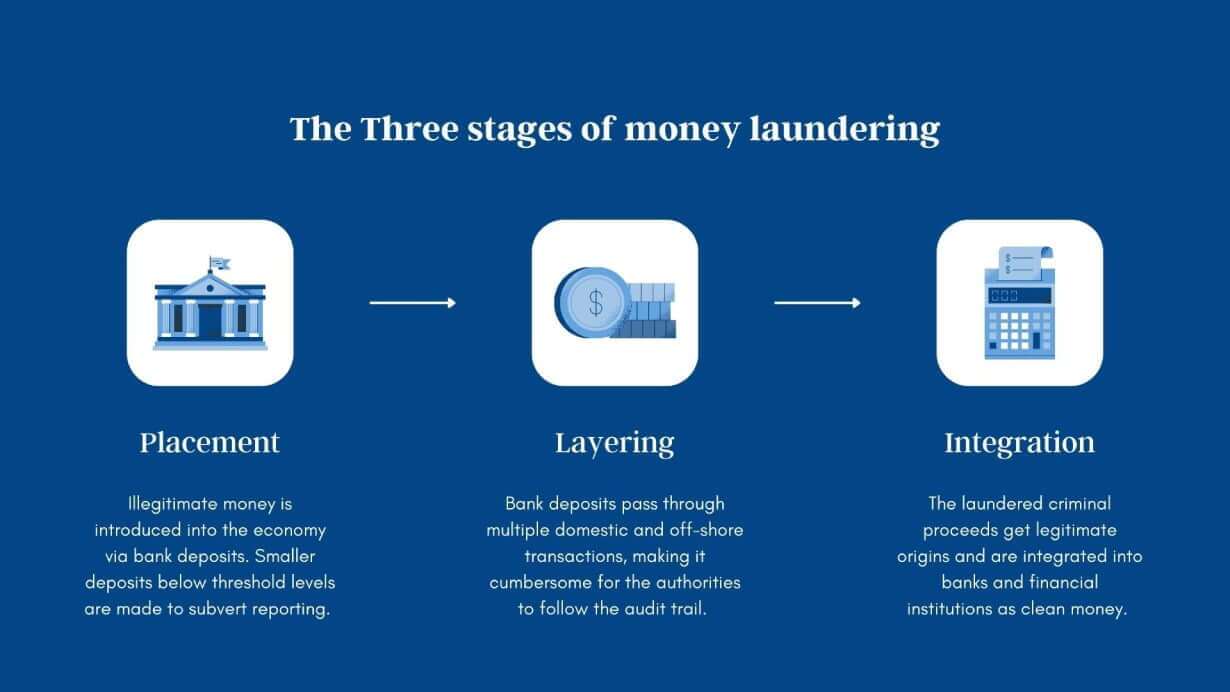

Let us discuss what are the 3 stages of money laundering. Since money laundering is a premeditated crime, it comprises i. placement, ii. layering, and iii. integration steps to make dirty money seem legitimate and bring it to the economy.

Placement

For money launderers, placement is the most vulnerable stage wherein the dirty money is surreptitiously introduced into the economy as monetary instruments or as direct deposits into the bank accounts. In the case of bank account deposits, smaller deposits below threshold levels are made to subvert reporting.

Since the money origin is illegitimate, placement involves the maximum risk. All jurisdictions worldwide have instituted stringent cash deposit measures to conform to Cash/Currency Transaction Reporting (CTR) filing obligations.

There are several ways of placing illicit money into the financial system, like loan repayment, gambling, fake invoicing, foreign exchange, and blending funds. Concurrently, money launderers exploit cash-intensive businesses that promote easy money movement, for instance, car washing, check cashing services, gaming, etc.

Opening foreign shell organizations or trusts and transferring cash below custom thresholds overseas to conceal the beneficial ownership is an intricate placement scheme that is difficult for the AML authorities to get hold of.

Layering

Once the money is placed into the bank in the first stage, the layering process disguises the illegitimate money source by maneuvering transactions and accounts. The purpose is to make it cumbersome for the authorities to follow the audit trail involving a series of domestic and off-shore transactions made using the different channels of payments.

Purchasing and selling expensive, luxurious goods – like land, jewelry, painting, etc. – is an example of layering in money laundering and is, in fact, the most favorable method for financial criminals to make use of their illicit funds.

One of the complex layering methods implies a series of irrational international transactions especially covering the jurisdictions that allow shell organizations and private banking. Abrupt holding company takeovers and real estate investments could also be set as pertinent examples here.

To move large amounts of proceeds of crime, money launderers hire professional bookkeepers to assist in fund transfers across international jurisdictions. Online remittance and crypto payments have aggravated the situation, especially with the ease of buying and selling cryptocurrency criminals misuse the exchanges to layer the ill-gotten funds and cover up their source.

Integration

Integration defines the final money laundering stage, wherein the illegally obtained money is returned to the legal financial system after completing the placement and layering stages. The criminal proceeds get washed off and integrated into banks and financial institutions as clean money.

Common integration tactics take in selling off expensive and luxurious items bought during the layering stage. Other instances are cash outflows from shell organizations, including fake payroll pay-outs, loan disbursement to shell company directors, shareholder dividends, etc.

Examples of Money Laundering

Drug trafficking is one of the most serious money laundering threats worldwide today. The narcotics industry is completely illegitimate and cash-intensive. Other examples of money laundering are human trafficking, arms trafficking, smuggling, bribery, corruption, etc.

Terrorist financing is a widely prevalent nuisance, and online payments and cryptocurrencies have intensified the situation. Many terrorist organizations today misuse digital finance to transfer terrorist funds across borders.

Other examples of money laundering comprise white-collar crimes such as corporate embezzlement and investment rip-offs, including insurance and mutual fund scams.

It must be noted that Trade-Based Money Laundering (TBML) is one of the most excruciating crimes, which is extremely difficult to trace and establish in front of the law. Today, Trade-Based Money Laundering (TBML) covers almost $2 trillion worth of global trade. Common TBML methods that money launderers exploit are over-under and multiple invoicing, over-under and inferior shipment, fake or phantom shipment, and shell company trading.

IDMERIT AML Solutions for Businesses

It is a general notion that anti-money laundering policies are meant for the banking and financial sector. But, in fact, all regulated non-financial industries like remittance, accounts, legal, insurance, investment, fintech, etc., now fall under the scope of AML-CFT obligations.

At the same time, regulations in high-risk sectors like cryptocurrencies, third-party payment processing, forex, casinos, gambling, etc., call for enhanced diligence methods to combat money laundering and terrorist financing threats arising from the ease of international transfers offered to individuals and merchants.

Combatting money laundering is a global effort; IDMERIT extends tailormade AML Solutions that operate in tandem with national and international AML-CFT guidelines. Contact IDMERIT IDMaml consultant and book a demo to understand more about AML requirements for your business.